How E340 Million was squandered

George Manyere, The man in centere of Ecsponent

Inside Ecsponent: How E340m was squandered

About 1500 emaSwati who invested in Ecsponent Eswatini Limited had their hard-earned savings amounting to E340 million transferred to various investments, including to South Africa and Botswana, without their consent and thereafter squandered.

The Ecsponent Eswatini Limited directors reportedly relocated the funds under the guise that they were invested in other companies to increase the individual investors’ returns and dividends. George Manyere and his group MHMK is allegedly at the centre of this squandering of emaSwati’s monies.

This publication has gathered that Manyere was the majority shareholder since 2016.

The company initially started operating in the country in 2010 and over years attracted a sizeable number of emaSwati who included retirees, pensioners, civil servants, church groups, and public and private cooperative societies, among others. Manyere was appointed as a director of Ecsponent Limited in 2016, was the controlling shareholder and a non-executive Director until January 2019. In 2019, he even took the operational reins not only as the major shareholder but also as the Executive Vice Chairman until 2020 when he became CEO of Ecsponent Limited (now Afristrat Holdings Limited).

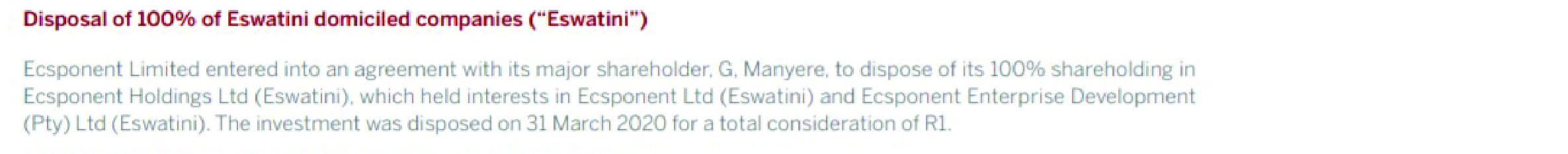

In 2020 , Zimbabwean-born businessman George Manyere acquired both Ecsponent Eswatini Limited and its parent company Ecsponent Holdings from the listed Ecsponent parent company where he was the major shareholder through his Mauritian-registered company MHMK Group for R1.

Notably, after the issue of the lost investors’ money came to the fore, this publication has gathered that Manyere rebranded the company from Ecsponent Eswatini Limited to ESW Investment Group.

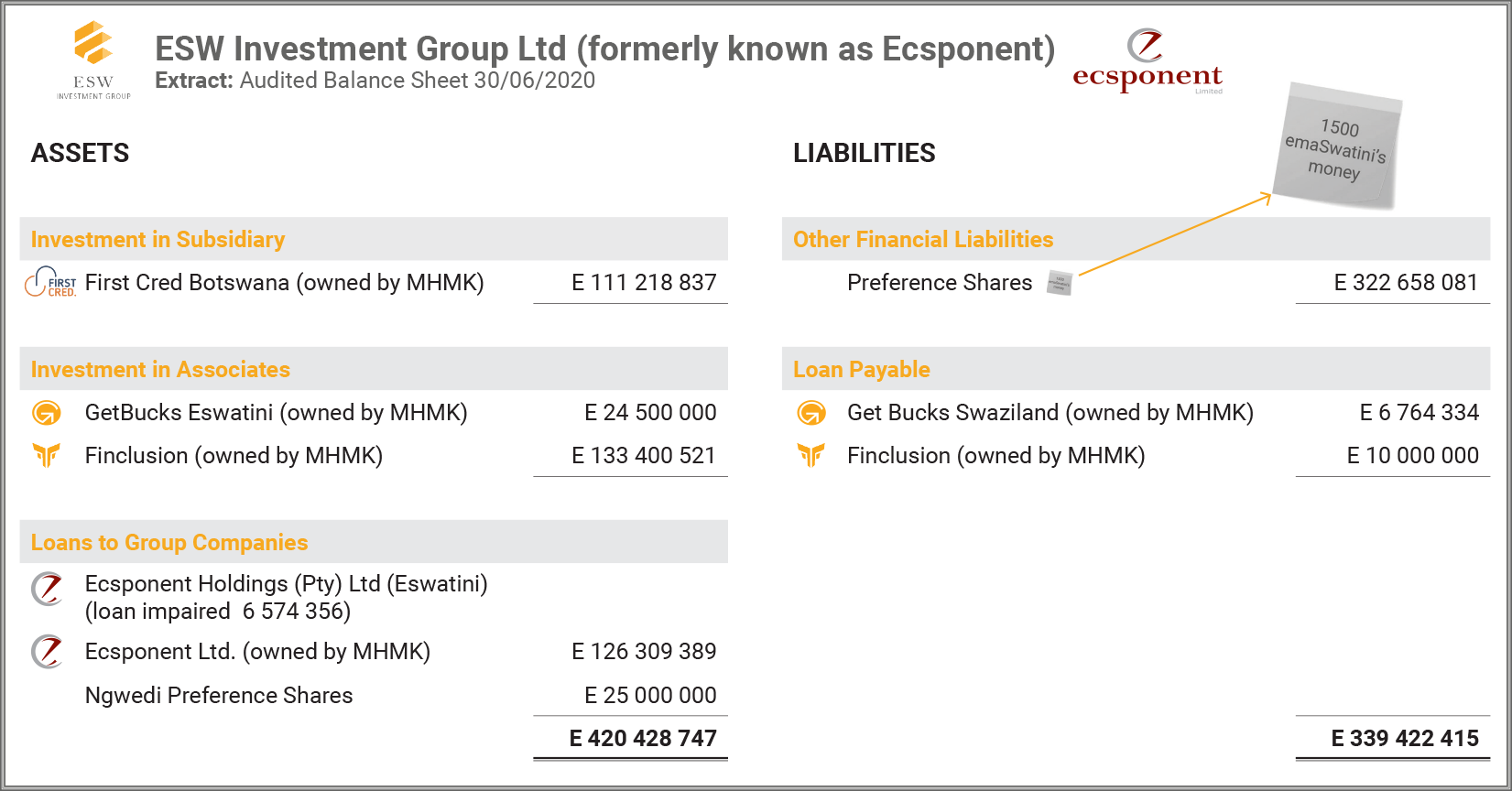

The following information is taken from the ESW Investment Groups audited 2020 financial statements:

Despite the undisputed evidence of the involvement of Manyere in the Ecsponent outrage, Global Fintech entrepreneur Dave Van Niekerk has for some reason been put at the centre of this scandal.

Recently, ESW Investment Group approached the High Court on an urgent basis, after learning that the duo of Dave Van Niekerk and Edwin J Soonious were in the country. It is believed that the two were alter-egos of Ecsponent Eswatini (PTY) LTD and GetBucks South Africa.

The court further directed the Royal Eswatini Police Service (REPS) and the Ministry of Home Affairs (Immigration Department) to assist in the execution of an order interdicting the two from leaving the Kingdom of Eswatini. Officials from the Immigration Department had been directed to flag and advise police officers upon seeing Van Niekerk and Soonious leaving the Kingdom of Eswatini through any of the entry or exit points.

Van Niekerk and Soonious were supposed to remain in the country until the finalisation of a legal action to be launched against them for the payment of the funds over the sum of E340 million to be instituted. The interim order was issued by Judge Justice Mavuso yesterday.

The two businessmen however, left the country despite the court order. Dave Van Niekerk came out, guns blazing and clarified that he did not run away from the court.

He categorically stated that the court application to restrict him and Edwin Soonius from leaving the country came to his attention on the morning of August 01st when he became aware of an article that appeared in one of the local papers in Eswatini.

He said that they were neither informed let alone served with a copy of the application nor the court order that was granted by the High Court to restrict their exit.

“I was in Eswatini on July 31 for a meeting. I flew back to the Republic of South Africa on the same day. After becoming aware of the application and the order granted by the Court, our attorneys on record obtained a copy of the application from the Court and filed a notice of intention to oppose,” he stated.

Van Niekerk further denied any involvement in the Ecsponent Group of companies and its holding company Ecsponent Limited.

He stated that it was peculiar that he has been cited in the application even though he was neither a director nor part of the management of the company “nor was I in any way involved in the Ecsponent Group of companies and its holding company Ecsponent Limited, now Afristrat Limited.”

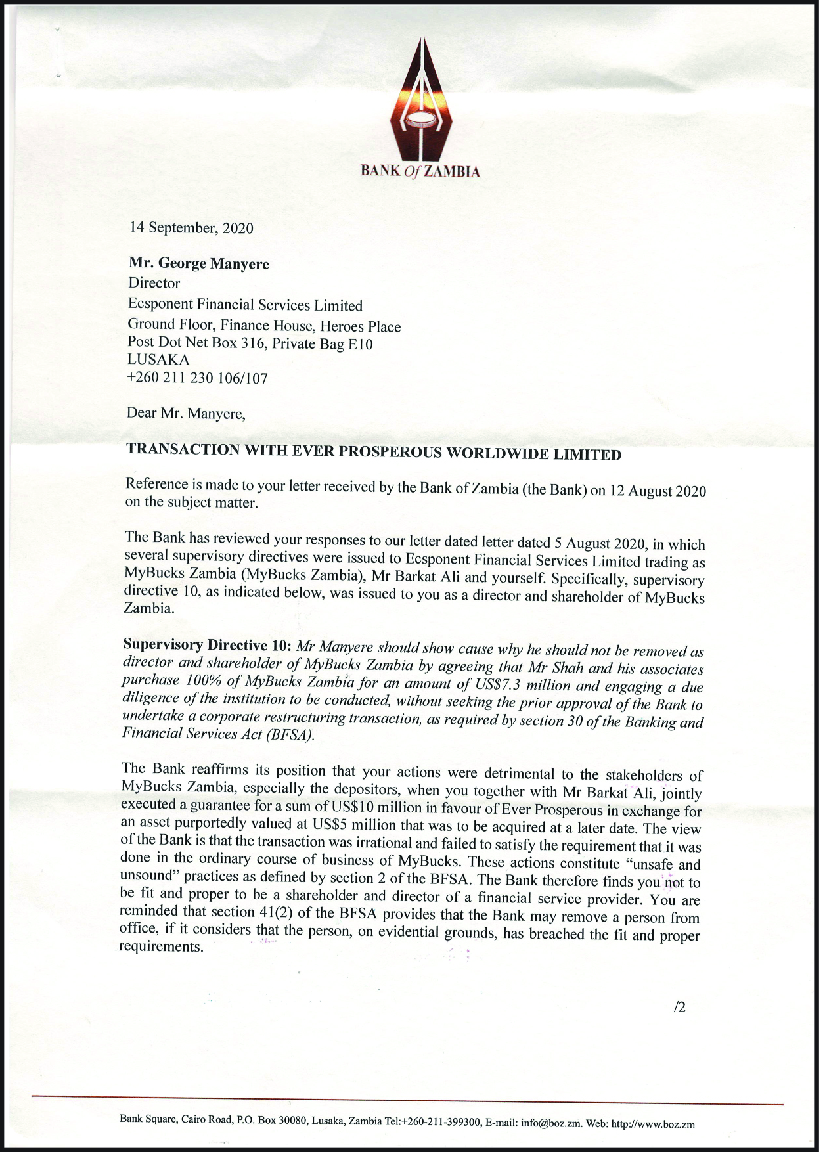

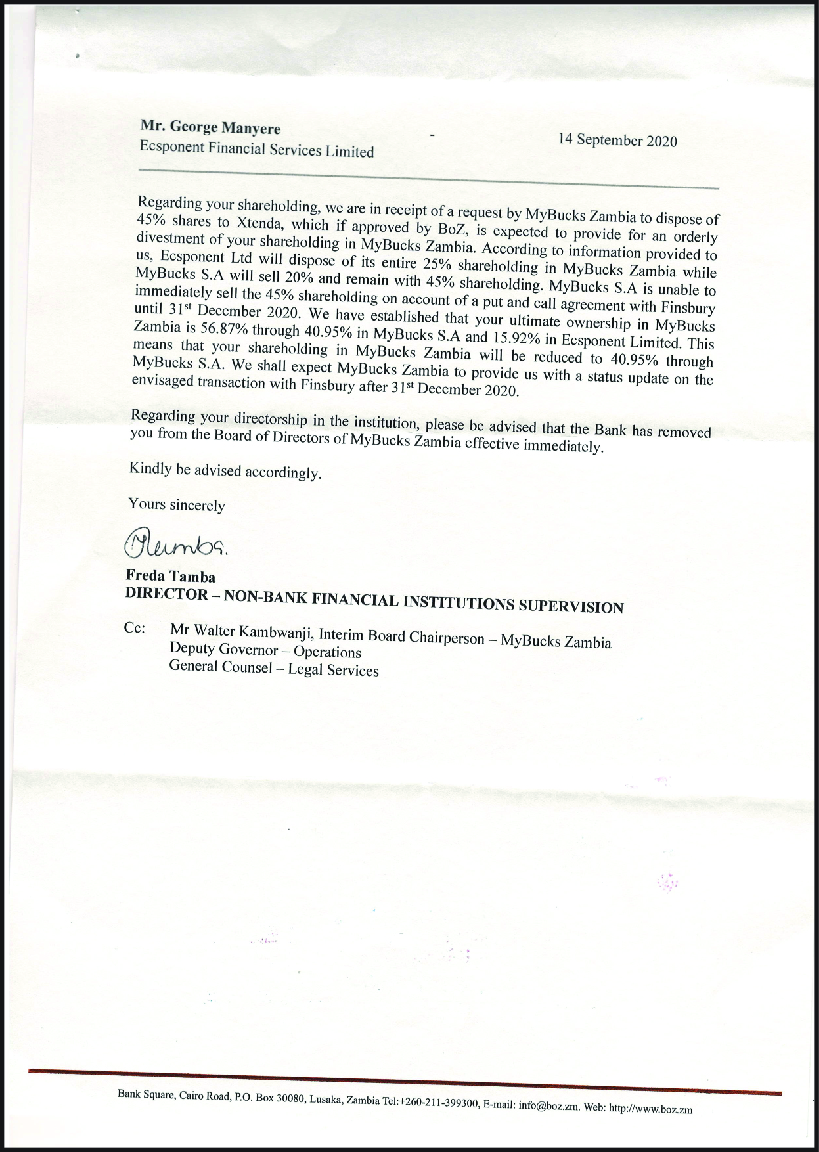

He added that the MHMK Group Limited has several on-going court cases in various countries. Furthermore the Bank of Zambia have also found Manyere not fit and proper to hold the position of a director of a financial institution or bank in Zambia. According to Van Niekerk, Max Mkhonza the newly appointed CEO of ESW Investments actually concedes that he has no personal knowledge of the apparent allegations and concedes that he (Dave Van Niekerk) was never a director of the company ( ESW or Ecsponent) . He claims that Dave Van Niekerk was a director in a South African company called VSS Financial Services and referred to an audit report which he alleges shows that I received funds. This company or supposed investment shows nowhere in the audited financials of ESW Investments ( Ecsponent Eswatini).

“He then alleges that I was the ultimate beneficiary of the funds. There are however no facts to support these allegations at all. The Forensic Findings Report makes no mention of any funds having been paid by the applicant to VSS at all. Furthermore, the issues addressed in the said report are not related or pertain to the applicant at all,” Van Niekerk stated.

He further elaborated that the issues raised in the said report have been investigated by the liquidators of VSS who have held a commission of inquiry into the affairs of VSS and with whom he has co-operated.

“VSS was the Fintech backbone of the MyBucks Group. VSS developed proprietary lending, banking, and Artificial Intelligence services and technology for the group. These IT systems won numerous awards in Germany and Luxembourg. It was a wholly owned subsidiary of MyBucks S.A. and provided the MyBucks group information technology and related administrative services and had nothing at all to do with the applicant. The Artificial Intelligence, Intellectual Property and Technology of VSS in which VSS expended substantial investment has disappeared since the liquidation of VSS. The liquidators are however investigating how this technology landed in the hands of Finclusion (ironically also an MHMK subsidiary as per their own website),” he stated.

In closing Van Niekerk points out the irregularities just keep coming. Tertius De Kock (Nexia SAB&T), who was the group audit partner responsible for Ecsponent Limited’s audit for the JSE (who signed off the group audited financials in Nov 2019) became the group CFO in March 2020.

George Manyere

Appointed as a Director of Ecsponent Limited

March 2017

Non-Executive Director until January 2019

Executive Vice Chairman until 5 March 2020

Chief Executive Ofcer of Ecsponent Limited

(now Afristrat Investment Holdings Limited).

Manyere controls MHMK Group

Manyere controls a group of companies that falls under a Mauritian registered Company called MHMK Group Limited (“MHMK Group”).

The group consists of various entities including:

ESW Investment Group in Eswatini;

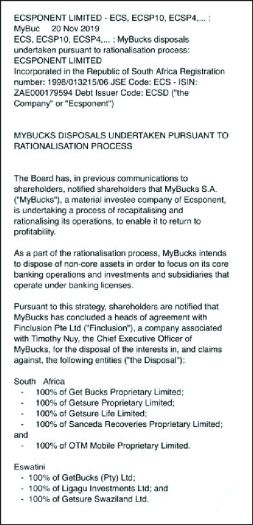

Finclusion Private Limited (This owns 100% of GetBucks

Eswatini, 100% of Ligagu Investments Eswatini, and 100% of Getsure Eswatini)

Manyere, through the MHMK Group controlled the majority of the issued shares of Ecsponent Limited through two of the companies within the MHMK Group of Companies, being MHMK Group and MHMK SA acquired in terms of the transaction.

shareholders

Ecsponent Shareholders 2016 to 2019

The Ecsponent Relationship With George Manyere Who Was the Majority Shareholder Since 2016 Explained in The Timeline of the Ecsponent Shareholders.

Through this history and timeline dated from 2016 to 2020, you can clearly see Dave van Niekerk was never a Board Member or part of Ecsponent’s Management.

Edwin Soonius, acting as Country Manager in charge of operations, was listed as a Director and never formed part of, or was part of, any

investment committees.

George Manyere and his other companies (Mason Alexander and MHMK Group) have been part of Escponent since 2016.

George Manyere

CEO of Ecsponent Limited.

Acquired the Ecsponent Eswatini businessfor R1.

A key figure of ESW as its Non-Executive Director.

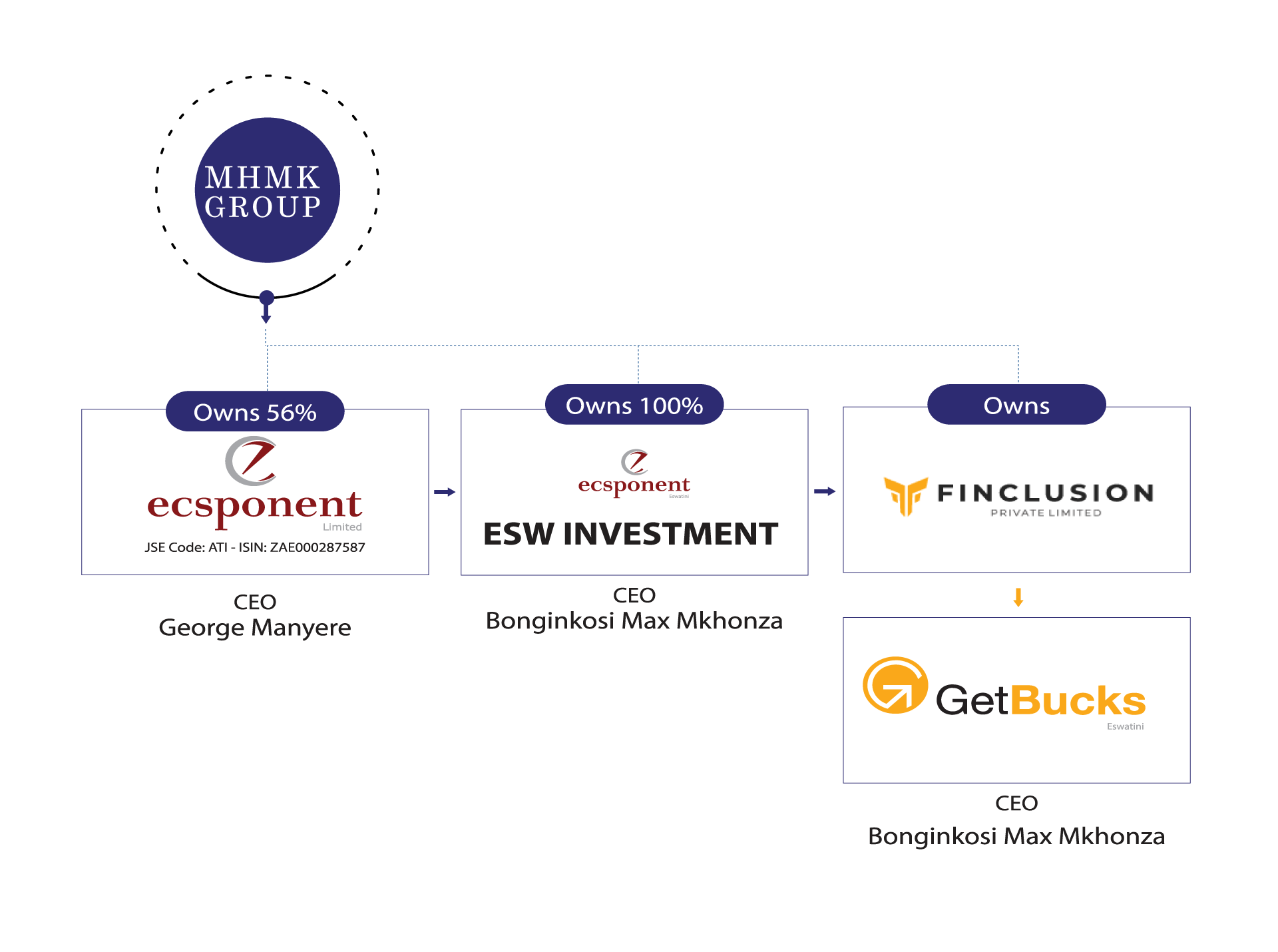

Bonginkosi Max Mkhonza

CEO of ESW Ecsponent (Eswatini) and GetBucks Eswatini.

2016

George Manyere Non – Executive Director

2017

George Manyere Non – Executive Vice Chairman

2018

George Manyere Deputy Executive Chairman

2019

George Manyere Acting CEO

Ecsponent

Explained

Acquisition of Ecsponent Eswatini (“Ecsponent Eswatini”)

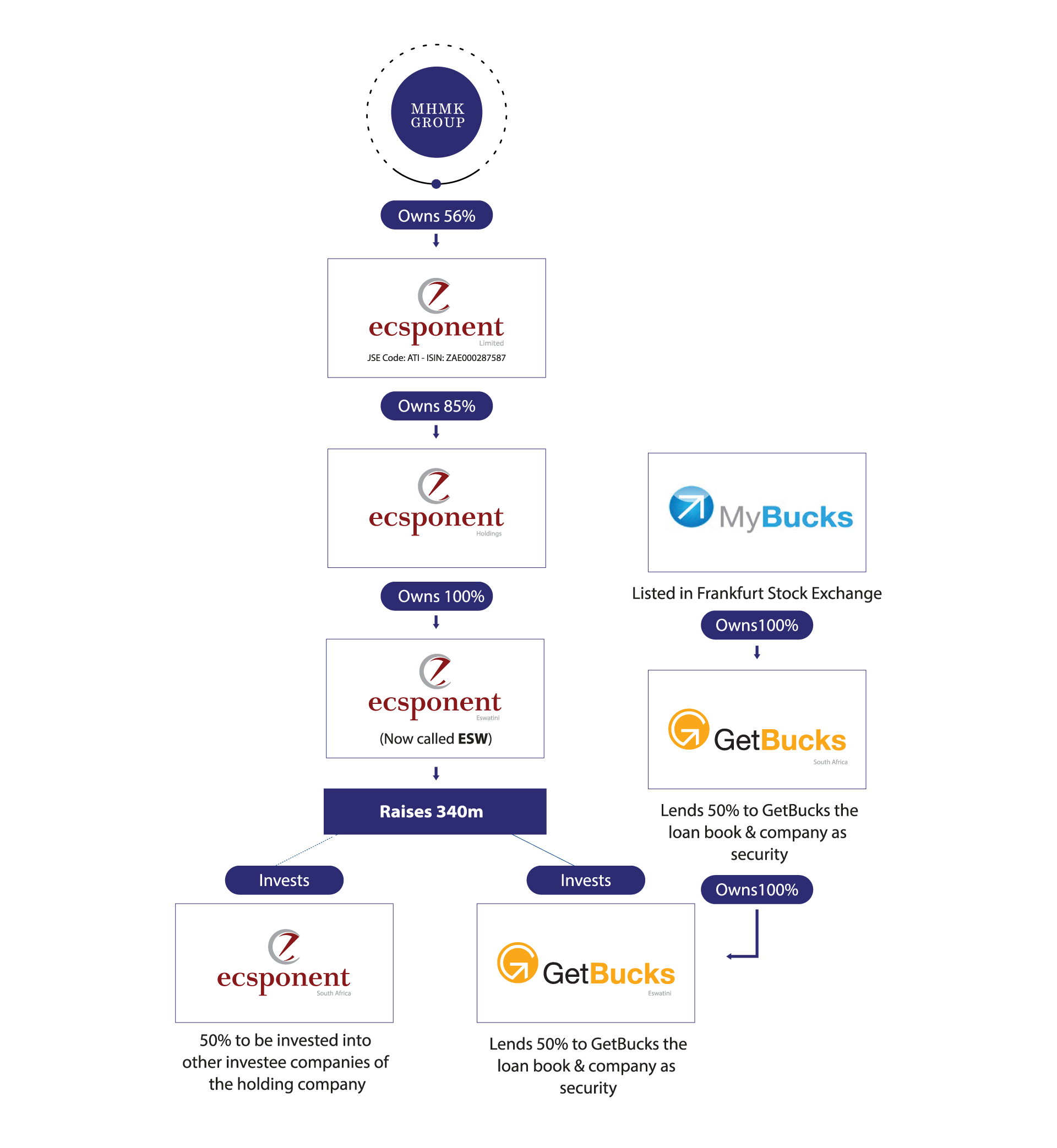

Preference Share Investment Conversion Ecsponent Eswatini was a majority owned subsidiary of Ecsponent Limited. Ecsponent Eswatini took funding from the public in Eswatini and provided credit facilities to GetBucks in Eswatini and to Ecsponent Limited, thus building a significant debtors book. Manyere engineered the conversion of the Ecsponent Eswatini debtors book into MyBucks shares contrary to local regulations.

The disclosures hereto were clouded by the noise around the bigger transaction.

Manyere as CEO of Ecsponent Limited, through his company MHMK, acquired the Ecsponent Eswatini business for R1. This was not reported to shareholders at any time and was only disclosed in a note to financial statements.

Preference Share Investment Conversion

The Ecsponent Limited business model has historically been based on retail investments placed with the company by South African and Eswatini investors. The total liability to these investors was over R2 billion and each investment had a 5 year redemption horizon.

The credit business model provided a healthy return which provided for both short term liquidity to service monthly dividend obligations as well as medium term redemption horizons which could service the capital redemption of the preference share investors.

The credit business model of Ecsponent Limited delivered healthy returns and provided both short-term liquidity (to service monthly dividend obligations) and medium-term redemption horizons (which could service the capital redemption of the preference share investors).

Ecsponent Limited was historically a large funder of MyBucks S.A (“MyBucks”) and its subsidiaries. The funding provided by Ecsponent to the MyBucks group was a significant profit generator for Ecsponent as the interest rate charged on the funding provided by Ecsponent to the GetBucks Eswatini was funded by Ecsponent Eswatini and the loan book and shares of the company were provided as security to Ecsponent Eswatini (this security has now disappeared, but is conveniently owned by Finclusion a subsidiary of MHMK).

Thus, any loss in the investors monies invested in Ecsponent ought to be attributable to Manyere (MHMK) and his conduct and activities ought to be investigated. The MyBucks subsidiaries where paying relatively high interest rates of round 25% per year. One of the subsidiaries was GetBucks Eswatini now owned by MHMK through Finclusion (The CEO is non other then the same CEO of ESW Bonginkosi Max Mkhonza).

George Manyere

Exposed

Snapshot from the MHMK investment website

Audited Balance Sheet 30/06/2020

MHMK Group

Original Structure

New Structure

In the news

Related News articles

News